Did You See Your Nonprofit Organization’s Form 990 Before it was Filed with the IRS?

Like, many of you reading this article, who are on the Board of Directors of nonprofit organizations, that may have a June 30 year end, and will have to file their Form 990 on the additional extended due date of May 15, 2011 with the IRS. So it’s that time to review the Form 990. As a board member, of a nonprofit organization as well as being chairman of the audit committee, I undertook to review the Form 990. This article will discuss just two simple questions on the Form 990, that deal with:

- Whether the Board was provided with a copy of the Form 990 before the filing with the IRS

- The process used by your organization to review the Form 990.

During my review, I noted that the changes to the 2010 return which included the following.

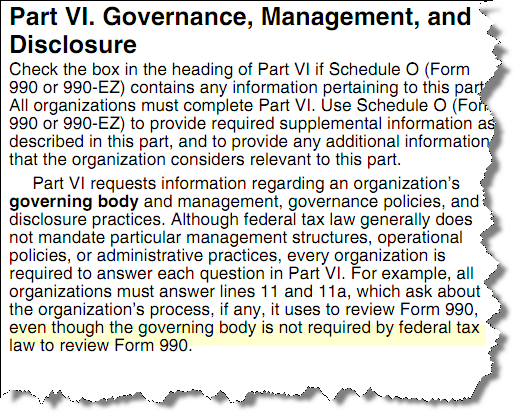

In particular, in Section VI - Governance, Management and Disclosure, there is a commentary by the IRS to the instructions to line 11. In that regard, the instructions clarify that an organization should answer “No” if it redacted or removed any information (e.g., names and addresses of contributors listed on Schedule B) from the copy of its final Form 990 that it provided to its governing body members before filing the form.”

In this connection, it seems that the IRS is continuing their focus on disclosure. The IRS is concerned whether a complete copy of Form 990 was provided to the governing body as the instructions so state. If a complete copy is not provided to the Board, then you should answer “no” to question 11(a).

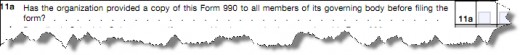

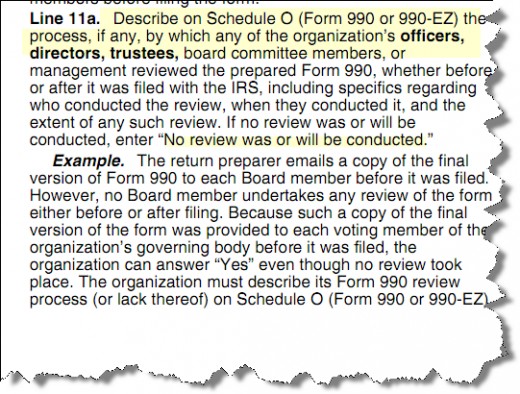

The Question from the Form 990 reads as follows:

Question 11a

This statement is clear that the IRS is very concerned about governance, management and disclosure which infers that the IRS's focus, among other things, is to ensure that the Board is aware of all of the nonprofit organization’s significant activities and, also to ensure that, if any items required to be disclosed are being redacted or removed from the governing body members before filing the Form 990 are noted as such by a “No” response to this question.

Please take this poll

Did your nonprofit organization provide you with a copy of Form 990 before it was filed ?

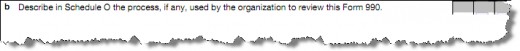

Question 11b

While we are on still on Question 11, this brings up the question as to whether the Board is required to review the Form 990 . The instructions on page 18 state that there is no requirement for the governing body to review. See the yellow marked excerpt below.

Instructions

Quite frankly, there is little, if no value in requiring that the Board receive a complete copy of the Form 990, if there is no requirement to review it. I would think that any board member would want to review the Form 990 before it’s filed. In case you have not reviewed the Form 990, after your review your knowledge of your nonprofit organization will be augmented.

If the organization that you are board member has not provided a copy to the board, then you may want to request copies be given to the board.

Although, based on the above there is no requirement for the Board to review the Form 990, the instructions on page 22 provide an example of what to do if the board does not review the Form 990 and more importantly seems to provide conflicting guidance. Here is a yellow marked excerpt of those instructions.

The next sentence is more interesting. Describe the process to review the Form 990. Care needs to be exercised to properly explain the review process or lack of review for this process in response to the IRS question. A suggestion is for the organization’s CFO to document the process, which will provide factual support of the process. The author notes that a typographical error in the instructions for 11a, that should be 11b.

Ask Yourself ?

Would you want to respond to question 11(b) and describe your process to the IRS that indicates that no review was or will be conducted?

Recommendations

Each nonprofit organization should document there is a policy that the Board of Directors to review( if you agree) the Form 990 on or before a certain number of days that it is filed with the Internal Revenue Service. There should be a board resolution approving the filing of the Form 990. There should also be statement as to the method by which the delivery of the Form 990 was made to each board member i.e. regular mail, e-mail, secure portal, etc..Naturally, this should be approved by legal counsel and your Board.

Any board member reviewing the Form 990 should do a little homework and get a copy of important areas to review.A helpful guide was prepared by a local CPA firm in Concord,New Hampshire.

IRS Support and Videos and QuickBooks

The IRS has done an excellent job trying to simplify ability to for the public to access the complex labyrinth of rules and regulations that exist. For instance a knowledge base has been prepared and is available on the web. However,for nonprofit organizations the IRS has produced a series of videos for tax-exempt organizations that might be a good refresher for your in house tax preparer to view.

If you are a small nonprofit organization you may want to consider QuickBooks

Summary

The Internal Revenue Service believes that the governing board of an exempt organization must diligently work to ensure that the organization fulfills its exempt mission and whether that includes the Board’s review of the Form 990, is up to you.